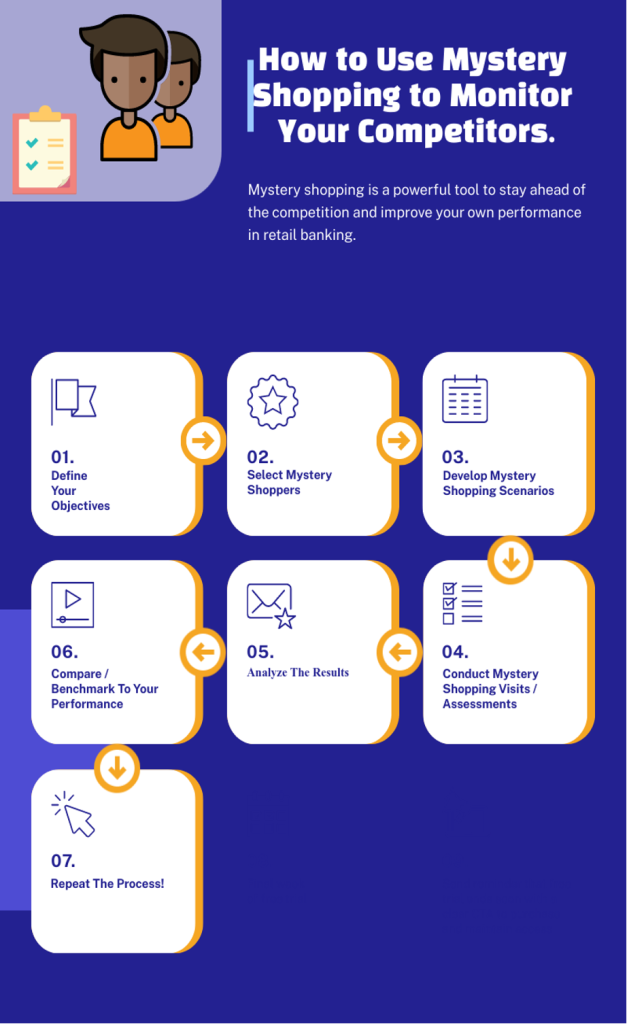

- Define Your Objectives: Before starting, determine what specific aspects of your competitors you want to focus on, such as their customer service quality, sales techniques, product offerings, branch atmosphere, and pricing.

- Select Mystery Shoppers: Choose reliable and impartial mystery shoppers who can accurately evaluate the competitors based on your objectives. Ensure they have good communication skills, attention to detail, and experience in retail banking.

- Develop Mystery Shopping Scenarios: Create realistic and specific scenarios that your mystery shoppers will follow, such as opening a new account, inquiring about a loan, or reporting a lost credit card. These scenarios should align with your objectives and cover all the aspects you want to monitor.

- Conduct Mystery Shopping Visits: Send your mystery shoppers to visit the competitor’s branches and follow the scenarios you’ve developed. Ensure they complete a detailed report of their experiences, including any positive and negative aspects they noticed.

- Analyze Results: Collect and analyze the mystery shopping reports to identify any patterns or trends in the competitor’s performance. Look for areas where your competitors excel and where they fall short compared to your own performance.

- Compare to Your Performance: Compare your own performance to that of your competitors and identify any areas where you need to improve. Use the mystery shopping data to develop action plans and strategies to enhance your own customer service, sales techniques, product offerings, branch atmosphere, and pricing.

- Repeat the Process: Mystery shopping is an ongoing process. Continue to monitor your competitors regularly and adjust your strategies as necessary based on your findings.

Remember, mystery shopping is a powerful tool to stay ahead of the competition and improve your own performance in retail banking.